News & Insights

Featured Article

The Ultimate Guide to Leisure and Wellness M&A

Understanding the significant interest from strategic investors in this booming category.

Forbes Insider Series

Selling your IT Services Business: An Interview with a Serial Buyer

IT Services and MSP Guide

The IT services and managed services provider (MSP) sector continues to grow at a healthy pace, fueled by a shift to cloud-based and SaaS applications, high demand for cybersecurity...

Capital Markets Update for Q4 2023

Through the fourth quarter of 2023, the market saw signs of normalization however, concerns about sticky inflation remain. The Q4 2023 Capital Markets Update report provides valuable...

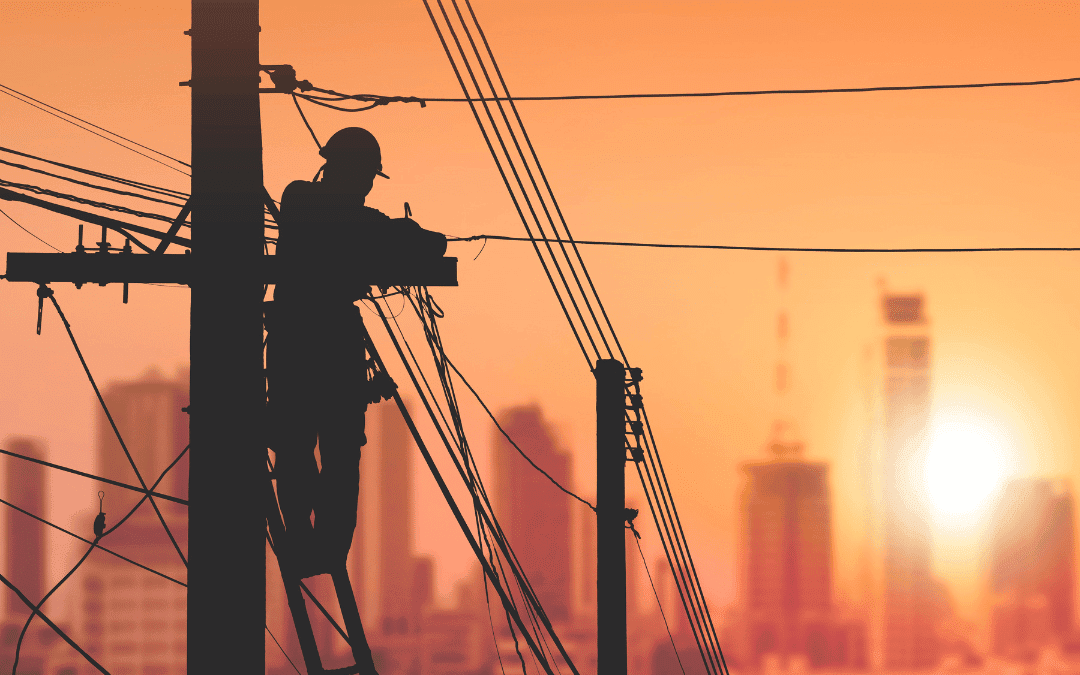

Industrial Services & Infrastructure Report – 2023 Review 2024 Outlook

The Industrial Services & Infrastructure sectors, spanning from essential utility services to advanced industrial solutions, showcased significant growth in 2023. These sectors,...

Home Healthcare Guide

The market for home healthcare services is growing rapidly, with Global Market Insights forecasting a 7.9% compound annual growth rate (CAGR) from 2022 to 2032, bringing the global...

Financial Technology and Services Guide

Per McKinsey & Company, revenue in the fintech sector is expected to grow about 2.5 times faster than traditional banking revenue over the next five years—putting traditional...

Case Study

How can the sale of high growth niche businesses be timed and orchestrated to maximize value? Read the case study on this award-winning deal to learn more.